Week 8: Neo-imperialism, Ant cut to size, Queen's Gambit, Macro data looks decent!

Happy new year! May you hit all your goals this year!

Another venture capital fund, this time Sequoia, re-iterated that Indian companies should be allowed to directly list on international exchanges. Presumably, they want this so that valuations can be maximised for their exits. However, I think this is absolutely unpalatable for India.

As I said last week, foreign funding for Indian start-ups is good. It provides opportunities for talented founders to attract risk-capital that may otherwise not be available in India.

While not being as deep as their US counterparts, Indian markets have richly rewarded the few tech companies that are listed (look at Info Edge and IndiaMart). VCs have nothing to fear by listing in India.

So when these start-ups become successful, on the backs of Indian customers, Indian employees/labour and Indian data/IP; Indians should get a chance to invest in them too. By listing them abroad, the common Indian essentially will never get a chance to benefit from the businesses that are built on his/her own custom and data. Not right.

Add to this the rising trend of VCs “forcing”, investee companies to “flip” overseas by transferring 100% ownership, IP and data to a foreign holding company (thus bypassing Indian regulators and potentially Indian taxes through transfer pricing).

China tells Ant to get back to basics. Regulators have told Ant, owner of one of two big Chinese “super-apps” to get back to their core payments business, and away from the most lucrative fee based lending, insurance and wealth management businesses. What a turnaround. From a potential $500bn listing valuation a few months ago to having the very core of the business model under scrutiny. The regulators said they will “resolutely” break monopolistic practice and have “zero tolerance” on any illicit financial activities. As I said last week with reference to Amazon, the only way these companies’ growth will be checked is if regulators or society as a whole decide to intervene. Absent that, these are probably the best business models… ever, and will only get more unbeatable and monopolistic with time and size. It’s inevitable, that is literally the business model.

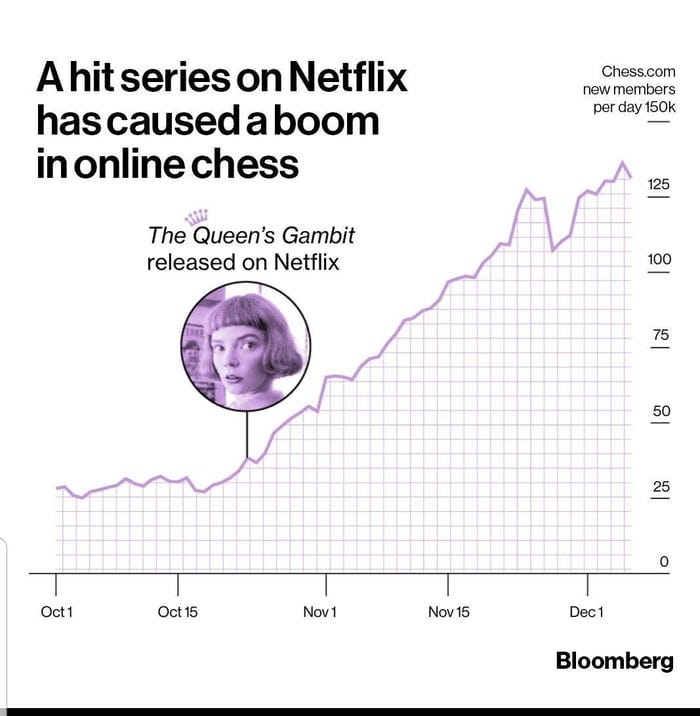

I watched Queen’s Gambit on Netflix this week, but got bored after two episodes and stopped watching. Clearly, I am in the minority, given it has become Netflix’s most watched show ever. Far more interesting for me is the chart below. See the apparent impact of a hit show on the underlying topic (chess.com members here). Given the much more reliable data analysis in these platforms, surely this is a whole new world for advertising. The possibilities are endless. Image source: Bloomberg.

Indian economic data continues to be positive in December.

GST collections hit INR 1.15 trillion from INR 1.04 trillion in November, the highest ever.

Power demand peaked at 182.88 GW in December, an all time high

Cars, 2-wheelers, tractors and heavy commercial vehicles sales grew well in December, especially for the market leaders

This is not an exhaustive list. Things look decent at the moment. Nice way to start the year, and certainly a far cry from what the doom-mongers predicted.