Week 6: America- print away!, Super(Whats)App, Movie Streaming Gains Stature, India's tragic value drain

The US Federal Reserve’s balance sheet hit a new high this week, as they said they will keep buying at least $120bn of debt per month until “substantial further progress has been made” in economic recovery. The balance sheet stands at $7.36 trillion now, and assets are up $3 trillion since the start of 2020 (up 77%). They also re-iterated their guidance to keep interest rates close to zero until at least the end of 2023. Where does all this money come from? They just “print” it digitally. You can hear it straight from the horse’s mouth here. Somehow seems unfair, no? The joy’s of having the world’s reserve currency. As they say, don’t fight the Fed, no matter how unsustainable you think this is.

WhatsApp is rolling out insurance products, and aims to facilitate the purchase of “affordable sachet-sized” health insurance through its platform by the end of the year. They have partnered with SBI General Insurance for this. They already started WhatsApp Pay (20m users so far it seems), and will presumably keep coming with new products for its 400m+ users in India. India doesn’t have any “super-apps” like Ant in China, but it does look like WhatsApp is in pole position for that mantle in the future. If WhatsApp India was listed, what would its market cap be?

WarnerMedia announced they will stream 17 movies simultaneously on HBO Max and movie theatres, in 2021, at no extra cost. This breaks with decades of convention where theatres always got an exclusive run on new movies before they were available for streaming or on DVD’s, cable and so on. Warner’s move seems decisive with even big budget films like Wonder Woman 1984 releasing for streaming simultaneously. While this may not be the end of the theatre business, things are changing and maybe the economics of the business will need to change too.

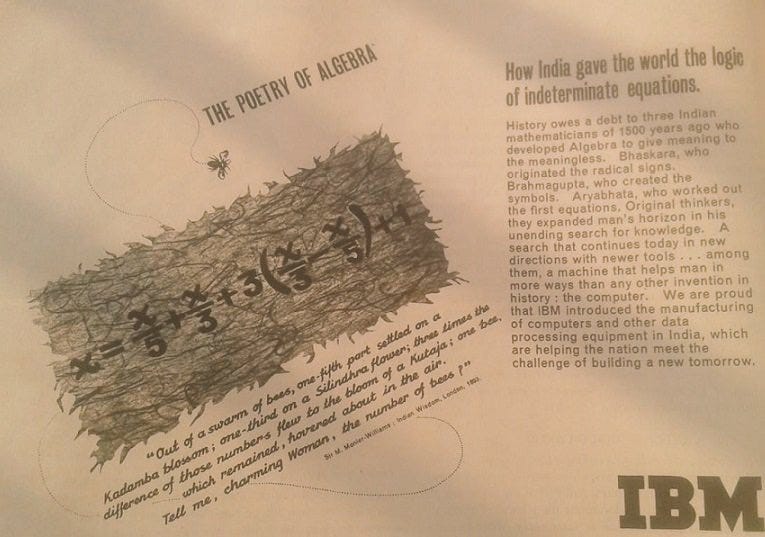

I came across this old IBM advert below from 1974, and loved it. Equally interesting, within three years of this advert, IBM left India after it refused to dilute its controlling stake as required by the Foreign Exchange Regulation Act (FERA) that capped foreign equity at 40%.

How times have changed and India has come a long way since. I dream of Amazon, Facebook, Google etc. being encouraged to list their local operations for Indian investors to participate in! I know it will open a Pandora’s box of problems, but let a man dream. For the harsh reality is that our best tech companies are owned by foreign investors in the private markets, and worse, may even list abroad when they mature.

Everyone will say that foreign investments are important for India’s economy etc. etc. I know. But did you know that India’s net imports of gold has exceeded net foreign investments (FPI) into India by $100bn over the past decade? This is probably a huge under-estimation, as it only accounts for official gold imports. There are reasons to believe most of India’s gold is in the black economy and dwarfs the official numbers. In effect, we are trading away our best, most future relevant companies for a shiny (mostly useless) metal. If only more of our domestic savings were channeled towards more productive assets.