Week 5: Bubble?, Banking disruption, AI assassination, Petrol 'lagaan'

Talk of equity market bubbles is back, and it is not surprising given the price action of several US tech IPOs. For example, the AirBnB CEO himself seemed shocked to know the opening price for his IPO. In India, the Burger King IPO was oversubscribed 157 times and is set-up to rise 60-80% when it starts trading next week. It seems to me like the set-up for a great equity market blow-off (to the up-side) is perfect:

Most bubbles are pricked by the actions of the central banks. The dotcom bubble burst when the US Fed raised interest rates suddenly. However, this time interest rates are ultra-low and the Fed has guided towards not raising rates till 2023, and in fact is still putting in more stimulus.

Digital brokers are introducing new people to the markets. From Robinhood in the US to Zerodha et al in India. Digital penetration, with huge tail winds since March this year, has made it easier and quicker than ever to open a new broking account and start trading on your phone. The new entrants tend to be from smaller towns and, generally, younger and new to equities. These new entrants have only seen stocks go up.

The underlying bullish story does make some sense. Rates are low, and the global economy is surprisingly strong, and markets do seem to be indicating a cyclical recovery (great article by John Authers on this).

New-age businesses are disrupting old profit-pools and are really difficult to value. For example, Wall Street can’t decide if Tesla is worth $90 or $780. All bubbles start with some basic correct premise: investors buying Amazon for what looked like a crazy valuation in 1999 were right in the long term (although it is another matter that most probably didn’t hold through the downturn and many wannabe Amazons failed).

No one really knows what will follow, but I won’t be surprised if markets remain strong for some more time. Anyway, Indian markets as a whole have not delivered any great returns. In USD terms, the NIFTY is up 3% a year for the past 10 years (8% in INR terms), while the smallcap index is up a pathetic 1% a year in USD terms (source Bloomberg). What bubble?

Some additional thoughts on what Stripe did last week, with the Stripe Treasury announcement. Most people believe that banks and fintech will ride on each other’s success, and fintech will enable better distribution for banking services, after all Stripe still needs Goldman Sachs as a banking partner. That may be true. But what if banks go down the same route that TV studios did with Netflix? Initially, studios partnered with Netflix to get digital distribution. It was only later that they realised Netflix would disintermediate them with its own studios (through better data insights and customer relationships). This story is happening in many industries. Amazon gives a third party seller a great platform for digital distribution, until the seller gets too successful (of which Amazon has perfect data), and Amazon Basics provides similar white-label products at much cheaper prices, with better product placement on its website. Rinse and repeat.

Iran’s top nuclear scientist was assassinated using a “satellite controlled AI machine gun”. The scientist was shot in a moving car while his wife, 25cm away, was uninjured. This is not sci-fi anymore, the future is here.

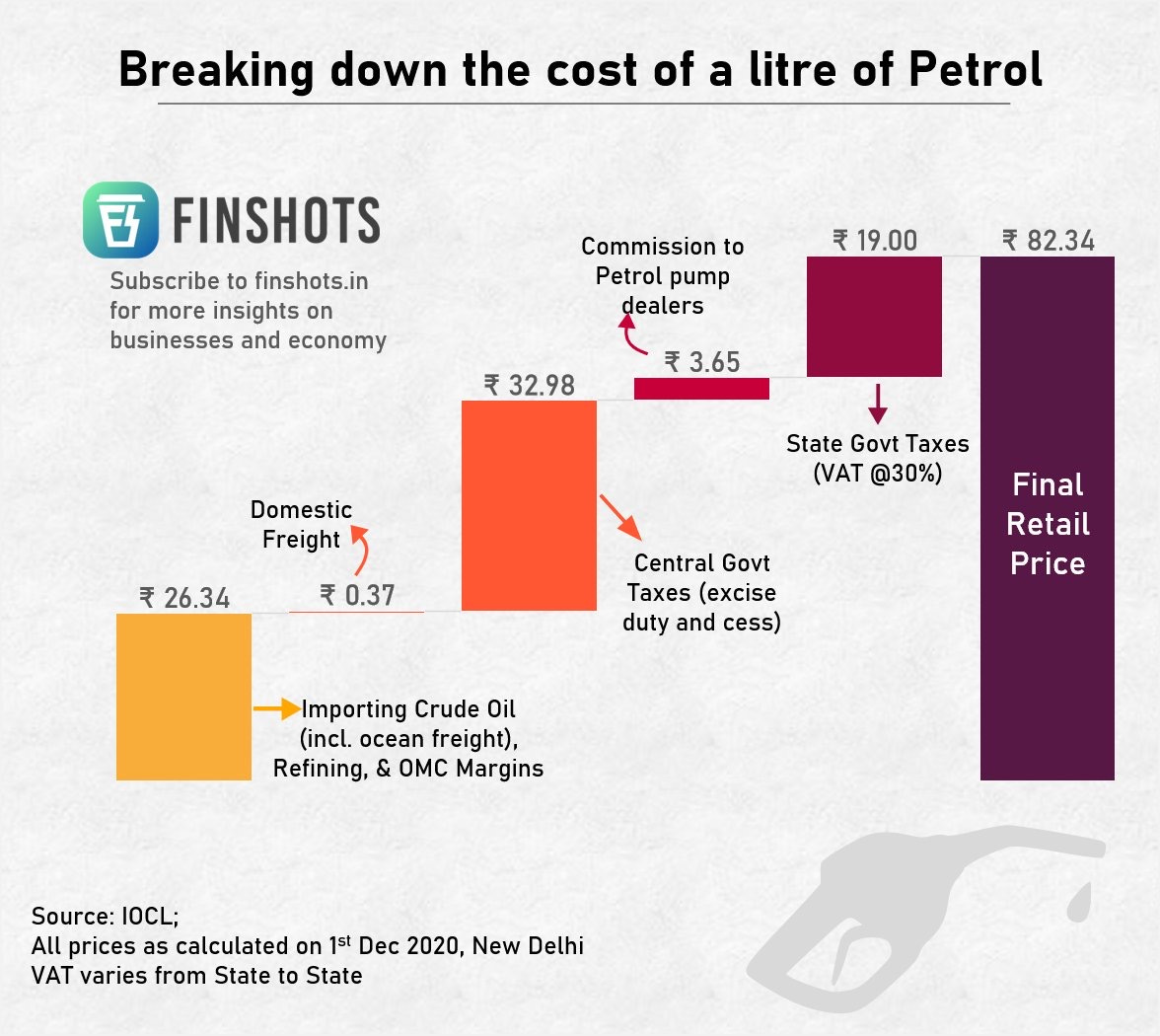

The well known and pathetic story of petrol costs in India (source: Finshots)