12: Sequoia insights, growth vs. interest rates, IPO market games

I enjoyed reading this letter from Sequoia to their investee companies. Two ideas stand out for me:

The economy (especially US) is really strong, with the second half of 2021 likely to have stronger growth than we have seen in decades. Add to that, (a) vaccines, (b) end to lockdowns (c) improved consumer balance sheet and (d) more record government/central bank stimulus; and you have a really strong economic backdrop (maybe too hot for the bond market?).

Covid pulled forward the future that technology companies are building towards. Behaviours that could have taken years or decades to mainstream were normalised in a few weeks.

Yet, over the past month or so, high growth stocks have taken a beating, due primarily to rising government bond yields. What’s the connection? This graph from Bernstein explains the crux of the problem.

Essentially, up to 99% of the value of a high growth company comes from the cashflows that they will generate far-off in the future (referred to as the “terminal value” in a discounted cash flow valuation model). In this example, that is cashflows generated after 10 years.

The valuation for these companies is hyper dependent on interest rates, which go into calculating the WACC (weighted average cost of capital).

So with rising interest rates (even if they are rising for the “right” reasons of an improving economy) will end up hurting the valuations of high growth, currently low profit making companies disproportionally (just like they were disproportionally helped in the falling interest rate scenario).

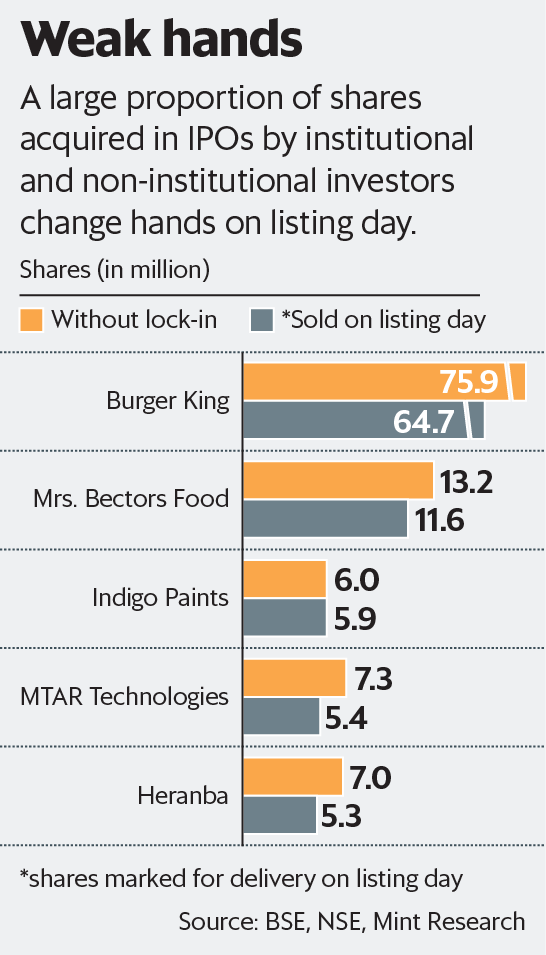

Indian IPOs have been hot recently, but then you have worrying statistics like this (source: Mint).

Almost everyone is selling the shares they are allotted in IPOs on the very first day of listing (those that do not have a lock-in). For example, 98% of all shares that were allowed to be sold in the Indigo Paints IPO listing day, got sold on the first day itself! Clearly, there is a speculative Greater Fool phenomenon going on. Not good.

Personally, I have two (opposing) thoughts here: (a) there are some clearly over valued (and even a couple of “fraudy” looking) companies that are IPO-ing, but (b) there are some really exciting tech enabled companies that are coming too. Interesting times ahead.